B2B Marketing Confidential is published by a twenty-year veteran of B2B Marketing who has worked with over 20 Fortune 500 companies. It aims to provide an unfiltered view of the craft from the perspective of a doer, as well as aggregating and analyzing major news from across the B2B marketing landscape.

Thursday, August 20, 2009

Scott Cross (Office Depot) Talks Efficient Customer Response, Customer-Centric Marketing, and ROI

---------------------------------------------------

AH: Talk a little about how customer data is being used to bring together vendors, manufacturers, retailers and distributors in a more customer focused strategy, and where that’s headed from a B2B perspective.

SC: The manufacturers don’t really understand who is making the decisions and what information is available within the network of their distributors and retailers. A lot of them aren’t set up to understand the information, and don’t have the capabilities to analyze it. So it’s really a green field, and that offers businesses the greatest upside today in the marketplace.

How can you get that data and marry it with the manufacturer? It’s critical because the manufacturer has the expertise when it comes to their products, customers’ behaviors and reactions to those products, and even customer trends when it comes to the features, benefits and requirements. What distributors and retailers have are customer data -- transactional and market basket data -- that completes the picture. So there is definitely room to grow there. For us, that’s where MarketBridge comes in: bringing the manufacturer together with the retailer.

AH: How has customer insight evolved at Office Depot over the past few years?

SC: Obviously, the retail sector is important for us, but there has been a big insurgence in B2B. But when you look at our customer base, about 80 to 90 percent of our customers are actually businesses now. So we really started trying to understand what drives their buying behavior, and who the decision makers are. In the past we did a lot of qualitative research. Any type of quantitative research was based on surveys, but we didn’t do a lot with customer analytics, database mining, and market basket analysis on the delivery side of the business with our larger contract customers. Most of the market basket analysis was done with the retail customer data.

So we’ve taken it to the next level by looking at the market basket information such as buying trends and behaviors, and looking at high value customers. Now much of our primary research is done with business customers rather than consumers. MarketBridge has played a big role in helping us understand that, and doing a lot of the modeling on our customer data set.

AH: As the manager around customer insight, what are the three most valuable reports that you receive or would like to receive? Which ones help you make better decisions about customers?

SC: I think ideally there are three reports managers want to see. First, a daily overall sales report that shows how you’re doing by product category and by channel is important, because every morning I can see whether we had a good day or a bad day and why, and the most effective channels from a product perspective. We’re also working to understand that at a customer level.

The ideal state is overall sales by product category and channel, and the second layer would be to look at that by customer segment. It’s the ability to drill into your sales vs. plan vs. last year, find out which categories are up and down, and in which customer segments.

The third report would be how we are doing against campaigns: how a campaign is performing by product category, customer segment, and by channel. Then, taking it even further, how a campaign is doing at the sales rep level. It’s really measuring the performance at a high level down to product, channel, customer and sales rep levels.

And the next step would be to get this information in real-time, and I think we’re headed in that direction.

AH: Given that, we often talk about the three dimensions of account structure, product market basket and marketing effectiveness reporting. How much importance do you put on those three when you’re managing your business?

SC: Marketing effectiveness is certainly important. You want to understand what vehicles are working and which customer segments are responding to which vehicles. In today’s economy, knowing which customer segments are doing financially better and have a little more money to invest in our products is important. For example, the public sector is definitely a growth opportunity in the current state of the economy.

Understanding the effectiveness of marketing to those segments is important, but just as critical is the product marketing basket and the account structure. For example, the product marketing basket allows us to understand that customers are buying ink, toner and paper, but they are no longer buying filing products, because budgets have been cut and they can reuse their file folders. So to understand how the product marketing basket changes by segment, by the cyclical nature of the economy and by the overall macroeconomic environment is important.

And the account structure is equally important. Knowing the difference between a small single-office customer down the street and a multinational corporation with small branches all over the country is key. At the same time, how do these different accounts make buying decisions? Is it the owner of a small business vs. the administrator within a large company? When you are able to marry those three together, it’s really powerful information to use in effectively marketing to your customers.

AH: Who understands customers better, the marketing organization or the sales force, and why?

SC: The sales force understands the customer better when it comes to interacting and knowing the way they customers think. When it comes down to one-to-one relationships, the sales force is number one. That said, the marketing organization is more effective in taking that information and using it to segment the customers into similar groupings, so you can have the same type of effect as with the one-to-one sales effort. So in looking at the overall customer base, how to segment them and market to them, and also which product or offering is most relevant to the entire set of customers, marketing is the most effective.

AH: Switching gears, you’ve got a market research person on your team and plenty of analytics people that are dealing with your core systems. How can market researchers and data analytics people better integrate to drive customer insight? How do you take those two separate tools and merge them together?

SC: Our philosophy is that research and analytics should be in the same group, because data is just another view of the customers, so if you can understand the customer through market research, you are getting a better picture of what the customer looks like. So market research and analytics go hand in hand.

AH: With your CPG background, you saw efficient customer response take off with retail scanner data in the supermarket sector, for example. Now it’s finally happening for B2B, and Office Depot is a pioneer in that.

SC: I do think we’re on the cutting edge. You always feel like it can’t go fast enough, and you’re always feeling behind when you look at retailers and all the information they’ve shared for many years. But it makes you realize there’s a lot of opportunity.

Friday, July 24, 2009

Three Ways to Track ROMI

Thursday, January 08, 2009

Thoughts on and Definition of Inbound Marketing (Listening)

Here's an ironic and unlikely hypothesis--marketing accountability has driven this trend. This is meant to be a controversial statement. Marketing accountability, otherwise known as “ROMI (return on marketing investment) measurement”, has forced the marketing function into a single role driven by a single metric—driving incremental, short-term revenue. Of course, this is an oversimplification. Many companies think “long-term” and do care about their long-term customer relationships. But, there has been, over the past fifteen years, an undeniable trend toward the short-term profit-driven marketing function.

- At AOL, in the late-1990s, marketers pushed an obsolete product to customers with such relentless efficiency that the company’s infamous CD-ROMs became the gag in its own television ads.

- Through the 1990s and 2000s, credit card companies pushed a product to customers that they knew will destroy them in the long-run, unapologetically. Letter after letter came for pre-approved cards, even when customers are teetering on the brink of bankruptcy.

- Pharmaceutical companies have given in to a seemingly never-ending arms race of more direct-to-consumer advertising and more physician detailing, leading patients to develop a deep distrust of companies that keep them healthy.

This sounds borderline socialist, but I assure you, I'll get around to making money. The question, however, is whether marketing must be considered a “zero-sum game” where a company treats its customers as wells to be tapped as deeply as possible, as quickly as possible. In future posts on inbound, I will make the argument that this objective is deeply flawed and must be changed by companies across the landscape. The goal of marketing must became customer advocacy.

Inbound vs. Outbound Marketing

A colleague of mine loves to talk about “inbound marketing”. The problem is, most marketers at big companies these days usually respond with a blank stare. For marketers at Fortune 500 companies, 90% of jobs are “outbound”—getting customers to buy stuff or feel a certain way. The inbound function is usually encapsulated in market research. But, even this has been gutted. Market research departments spend a lot of time figuring out how to sell better to customers. Their business customers are compensated on “selling more stuff” so they need “actionable research.” This is all great, but something has been lost in the shuffle.

Here’s a first attempt at a definition for inbound marketing:

Inbound Marketing: The voice of the customer manifested inside the company.

- A good start, but not very descriptive. The voice of the customer, manifested inside the company, could be one person aggregating a bunch of customer feedback speaking to no one in particular.

Inbound Marketing: The voice of the customer manifested inside the company, that acts as an empowered advocate for customer needs across all company functions.

- This is much better, because now the voice of the customer is actually changing the way the business operates. But something is still missing, which is how this customer advocacy is gathered and communicated.

Inbound Marketing: The voice of the customer manifested inside the company, that acts as an empowered advocate for customer needs across all company functions, gathered through the ever-increasing digital interactions and channels available.

- This definition brings together the what, the why and the how, and seems pretty comprehensive and precise. A lot more work needs to be done to flesh this definition out, which will be the subject of future posts on this topic.

Thursday, December 04, 2008

ROMI White Paper

Over the past few months I've worked with a colleague of mine, Alex Aldag, who used to be at Channel Economics and is now a Principal in the analytics group at MB, to write a pretty interesting white paper on the challenges of measuring ROMI in a B2B environment. There's some good data we've gathered from a bunch of industries in there. You can reach it here after registering.

Some Outtakes:

On Return on ROMI:

- "Given increasing financial pressures, it is likely that senior executives will continue to be more and more critical of corporate spending. Marketing budgets are frequently perceived to be more discretionary and less directly tied to firm performance. As marketing mix shifts, it will be increasingly critical to adapt measurement and reporting practices to account for new stimuli put into market. Nearly 80% of firms that employ ROMI measurement today assess their marketing performance as somewhat to highly effective, compared to only 42% of firms that do not measure ROMI." (TNS Media Intelligence; TNS Media Intelligence Reports U.S. Advertising Expenditures Declined 1.6 Percent in First Half 2008; 9/24/2008)

- "Nearly 80% of firms that employ ROMI measurement today assess their marketing performance as somewhat to highly effective, compared to only 42% of firms that do not measure ROMI" (Lenskold Group; 2008 Marketing ROI & Measurements Study; 2008.)

- Just over half (54%) of companies have access to aggregated sales reports at a weekly or daily level. Even fewer (33%) have access to marketing spend data at a weekly or daily level. Data issues generally require the analysis to leverage proxies and a variety of aggregated data forms. (Lenskold Group; 2008 Marketing ROI & Measurements Study; 2008.)

Saturday, November 22, 2008

Using Customer Equity as a Dependent Variable for MarComm Optimization

Rust, Lemon and Zeithaml, in their 2004 Journal of Marketing Article "Return on Marketing: Using Customer Equity to Focus Marketing Strategy" have a neat solution. It's to make the dependent variable the customer. In other words, when making marketing investment decisions, companies should understand how each investment impact core "orthogonal perceptions" for each of its customer segments, and then trace the impact of these perceptions on customer behavior in the form of acquisition and retention. They suggest thinking of each customer relationship as a string of future actions--either they will or won't buy, at different amounts, through time. They do this using a mathematical technique called a Markov Chain.

- How do we understand the impact of marketing investments on perceptions? The marketer still needs to do research, in the form of recognition tracking through time, to understand this.

- How do we understand which core attitudes are truly important? Market research needs to be done, in the form of qualitative followed by quantitative research, to understand the constructs that truly drive acquisition and retention behavior. In the article, the authors tested questions on inertia, quality, price, convenience, ad awareness, information, corporate citizenship, community events, ethical standards, etc totally 17 questions. They used PCA (Principle Components Analysis) to whittle this list down to 11 constructs.

- Customer segmentation. Not all customers act the same way, and the more discrimination we are able to build into our model, the better. Ideally, we'd like a unified segmentation to drive our research here.

- True short-term goals. While this approach can theoretically handle all marketing activities, it doesn't describe how to handle true short-term actions. However, I think it's pretty easy to bolt this on. Because we're looking at customers as the dependent variable, we'd simply add on known short-term acquisition and retention levers to only impact the first step of the Markov Chain. If an email acquisition program drove 5% of a segment to but, we'd simply add 5% onto the first Markov chain probability.

There's a lot more detail to this, but it should give a taste to the marketer who's interested in using customer equity as a dependent variable for ROMI / mix modeling. If there's more interest, give me a shout, go to MarketBridge and register your name, or download the Journal of Marketing Article (or all three).

Wednesday, December 06, 2006

AHP to do Mix Modelling?

They also admitted that most of the time, the reason they do hardcore quantitative optimization is for organizational buy-in reasons, rather than true quantitative rigour. I'd concur--I've seen similar things come up in my clients over the years. However, using AHP to optimize mix does not mean that all the good ROMI work can get tossed--far from it. In fact, it's critical to understand the outputs of each marketing tactic quantitatively. What AHP does is function as a team-based tradeoff / optimization model--but the individuals involved still need good information on how different tactics are likely to pay off.

This is why building out the marketing metrics and the response curves is still critical. So, don't get excited, you still have to measure marketing. Before you start AHP, it's helpful to have a robust list of metrics on a per tactic or per segment basis, such as:

- Rough ROI on a gross margin basis

- Diminishing returns levels--where does the curve get steep?

- Non-financial impacts due to different types of marketing

- Segment-specific "sweet spots"

- Current attitudinal levels by segment, country

- Etc.

There are some good software providers out there for AHP--one of my favorites is a DC-based company called DecisionLens.

Wednesday, November 15, 2006

Brand Valuation: Finance vs. Marketing

"There was no mention of 'peeling back the brand onion' or 'aligning the brand's design elements to fit the emotional state of the desired consumer'... In short, the discussions were about how senior management and the financial and accounting people view brands than how the marketing people do it. And that's the side of brands and branding I don't think we marketing people see often enough, certainly not if we look at the marketing and communications press or the content of the multitude of brand conferences and seminars that seem to go on continuously."

Clearly, Schulz is frustrated by a failure of dialogue between the marketing department and the finance people. Interestingly, however, I think this is one area where B2B marketers may be in the lead. B2B marketing departments tend to have a lot more finance and accounting types floating around to begin with, largely because the pipeline focused nature of B2B marketing demands this kind of skill. Thus, it is much more common to hear B2B marketers talk about ROI than it is about "brand message having a semiotic balance with the five human senses."

What I've seen happen in B2B organizations is that the folks running the channel or the pipeline eventually find the branding people and get frustrated. The direct side of the business can measure (well, at least in general) its performance using hard numbers. Why can't the branding side of the business do the same? More often than not, this serves as a forcing function for the brand folks to at least start to value what they're doing. Of course, this valuation is much more difficult, but this is no excuse to not start the climb.

The takeaway from the Marketing News article seems to be that better dialogue is required between finance and marketing today. I would argue that B2B marketing orgs could serve as a "best practice" for this kind of integration. Maybe this is one area where B2B is actually ahead of B2C in marketing.

Wednesday, October 25, 2006

Mix Optimization at Wachovia in Business Week

Business Week highlighted Wachovia's efforts at media mix optimization this week. Yes, I know it's mainly B2C, but still it's interesting that this is starting to get attention from the mainstream business press. The article is actually about Jim Garrity, who came from IBM and has focused Wachovia's marketing department pretty relentlessly around measuring ROI. There isn't a lot of detail in the article, but I thought it was worth noting nonetheless.

Garrity does mention that their modeling is a "work in progress," and that if they'd used only the model to allocate marketing, they would have allocated 40% of their budget differently. This isn't surprising--management judgment or "a priori" decisions often trump model outputs, particularly around hard-to-measure channels such as golf sponsorships.

Another interesting point is the subtle distinction between "channel mix"--e.g. broadcast TV vs. events--and "sub-channel mix"--e.g. sports vs. news. I think agencies are still very strong on the latter. They have the models to know which of Wachovia's customers watch what programs and how often. Where they fall down is the more macro "channel mix," largely because of conflicts of interest (why would an agency recommend cutting broadcast TV in favor of events?)

I also wonder how much of Wachovia's decision model is around linear ROI vs. response curves. For example, do they get a report that says "ROI for TV is negative, cut it" or do they get a report that says "ROI for TV is negative, but it will be positive at 72% of its current level." I'd imagine it's the latter.

On a final note... I wonder how the Philadelphia Flyer's miserable start has impacted their decision to own the naming rights to the Wachovia Center? Sorry, just couldn't resist.

Monday, October 23, 2006

Marketing Stim-Response Data Warehouses

Answer: A marketing stimulus-response data warehouse.

I was reading the marketing news this morning and came across a press release for a "Physician database marketing system" from CPM that "is specifically designed to link internal, external and computed data to the main consumer CRM system..." I have no idea if this system works or not, but it highlights an interesting trend. I've started to see these "supplementary data warehouses" in the market place... Another good one to look at is Upper Quadrant.

CRM systems, I would argue, are first and foremost about capturing transactions through a user interface. Even Siebel's Marketing Enterprise is largely about getting program planners, direct marketers, etc., to enter in their campaigns, tactics, etc. in an organized way. This was information that was, before CRM, largely uncaptured. Where CRM systems have fallen down is giving a holistic view of sales and marketing stim-response across the enterprise. This is because CRM system are, by definition, somewhat siloed (or a lot siloed). It is unrealistic to expect the Salesforce.com installation to contain financial outcomes of leads, a complete view of the marketing database, time series data on advertising, etc.

So, the solution is the marketing data warehouse. Up until now, these have existing in two flavors and they were almost always customized / built by system integrators. Flavor one are the customer / lead / direct marketing data warehouses. These are primarily executional. Flavor two are the stim-response databases that tend to be primarily analytical. There are a couple places where I've also seen attempts at one data warehouse that covers both executional DR and analytical in one.

My point here is simply that there is huge white space for a company that can come in and deliver a largely pre-baked marketing data warehouse solution that pulls data in from CRM, Marketing Automation, ERP / Financials, and, most importantly, commonly used external sources. Getting back to Upper Quadrant, they are starting down this path. They are building the hooks into Nielsen, common call center switches, competive data, media trackers, etc. so that customers can get marketing data warehouses up and running quickly. It should be an exciting space to watch over the next couple years.

Saturday, October 21, 2006

The Mix Optimization Craze, Part 1

Over the past several months, I've received more RFIs and RFPs for marketing mix optimization / media mix optimization than I had received over my entire career up to this point. This could we've been doing a better job marketing ourselves, but I think it's something deeper than that. My hunch is that mix optimization is the "new CRM" and that, as with CRM, expectations are an order of magnitude too high.

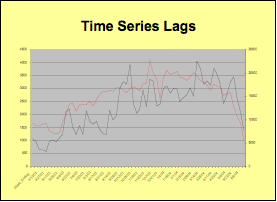

So what is media mix optimization when you strip away all the trimmings? Essentially, you're trying find relationships between stimulus and response data using regressions. The data are typically arranged in time series. In consumer industries (CPG, retail, telecom, etc.) companies have been doing mix optimization since the early 1970s, so much so that is has become essentially commoditized. Once you have the algorithms built in a stable business, it becomes a largely plug-and-chug exercise.

So why is B2B marketing so late to the party? I see three main reasons.

1. Large transaction sizes. Because transaction sizes are large, transaction volume is smaller, making response data sets too "chunky" for easy analysis.

2. Long sales cycles. In consumer industries, transactions can hit financial systems minutes after a television ad is aired. In B2B, the effects can take months.

3. More dynamic business models. B2B industries typically undergo major transformations every couple years or even every year. For example, Microsoft's continuing product launches make it difficult to separate out the "marketing signal" from the other stuff.

These three factors make it pretty tough for B2B marketers to really optimize their mix. But, instead of starting slow, most companies seem to be trying to do everything at once.

I see four steps to getting to true B2B mix optimization. Each step can take months or even longer.

1. Understanding total spend on marketing and automating. Many B2B marketing orgs still do not have clear understanding of their total spend / stimulus to the market. Efforts to aggregate it tend to be manual, because data in accounting systems are not aligned with business taxonomy. So, before starting a big mix optimization program, it's pretty important to a good automated view of spend and stimulus across all marketing vehicles.

2. Establishing causality. Before starting to do mix optimization, it's nice to know what's causing what. Most marketers know the ROI for direct response marketing--at least they think they do. However, they have no idea what effect "above the line" media is having, or the interaction effects between different kinds of media. This is typically step 1 of a media mix project. You need time series stim-response data to establish what I call "linear causality".

3. "Direct effect" regression-based mix optimization. Direct effect regression looks at how media affects sales over a short period of time. Direct effect regression is traditional media mix optimization, typically working over a three-month period, maximum. The weakness is that it can dramatically underestimate the value of marketing, specifically in a long sales cycle business.

4. "Indirect effect" mix optimization. All this means is that we're looking for the effects of media / marcomm on both behavioral metrics such as sales and on attitudinal or latent variables such as awareness, affinity, net promoter, etc., and that these attitudinal variables affect behavioral metrics over the long term.

I have a hunch, though, that a lot of companies don't understand this. They're getting promises from vendors that they can get to step 4 in a couple months, and skipping over the basic blocking and tackling to get there. In my next post, I'll talk more specifically about the vendor landscape and a recommended conservative approach to tackling mix optimization.