Having covered that ground, let me state up front that this post is not about pipeline management, acceleration, nurturing, systems, or email marketing. This post is about a fundamental problem with the funnel concept as operationalized at most B2B marketing organizations today, and what I think is a pretty seminal idea on how to fix the problem.

The problem with funnels is that they're missing a lot of the folks that are actually going through the purchase process. This is because we as marketers are dependent on our own internal systems to track these folks. Our own websites; our own emails; our own sales reps; you name it. However, we know there are many individuals with needs that are going down an awareness / consideration / trial / purchase process that we are completely oblivious to. I call this the latent pipeline. For analytics geeks, this should be a comfortable term. It is the implicit pipeline that we don't have information about but that we know exists.

I'd argue that the latent pipeline can be broken into two parts. The first part is the upstream part of the funnel that could be defined as "pre-company web site". This is when latent prospects are starting to think about their needs and what they're going to go do. Today, this is going to be largely addressed via search, assuming that we can intersect people when they type in search terms. There is no question that this is a powerful tool for intercepting prospects, but I'd argue that there's an even more powerful way to target them. More on that later.

The second part are the folks that are going through our stages, as defined via our systems, that we don't know about. So, when we have 10 leads that are "qualified", there are another 50 leads out there that are being qualified by other companies. We don't know about them, so chances are, we'll never get to pitch to them. Ouch! That's pretty harsh.

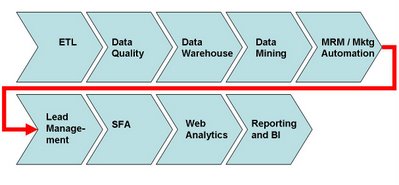

So, we've defined a pipeline that has an explicit and a latent component, that will look something like this:

This fundamentally changes the concepts of B2B marketing, when you think about it.

- Acquisition marketing really becomes about understanding the top of the latent funnel

- The scope of CRM can be expanded to include not just leads / opportunities in our CRM system, but to leads / opportunities in other company's CRM systems

I'm not suggesting that we all go do industrial espionage and steal other firm's CRM data. I'm suggesting that through online audience ownership, we can extend the CRM layer from the explicit to the latent, via display advertising. I already posted on this once, so read that one. Basically, I'm arguing that we need to take a few steps to own the latent pipeline:

- Understand our audiences

- Map their typical B2B Internet behavior and map their pre-buying cues

- Build analytical models to tag them

- Target them via display advertising before they ever come to our site

- Keep doing search marketing

In other words, create a rich, targeted online tapestry that is always on, and no longer shackled to company web sites and email. B2C marketers are ahead on this, but B2B has so much more potential.

I know this needs more detail. Next post will be on how one might do the steps above and make it work.